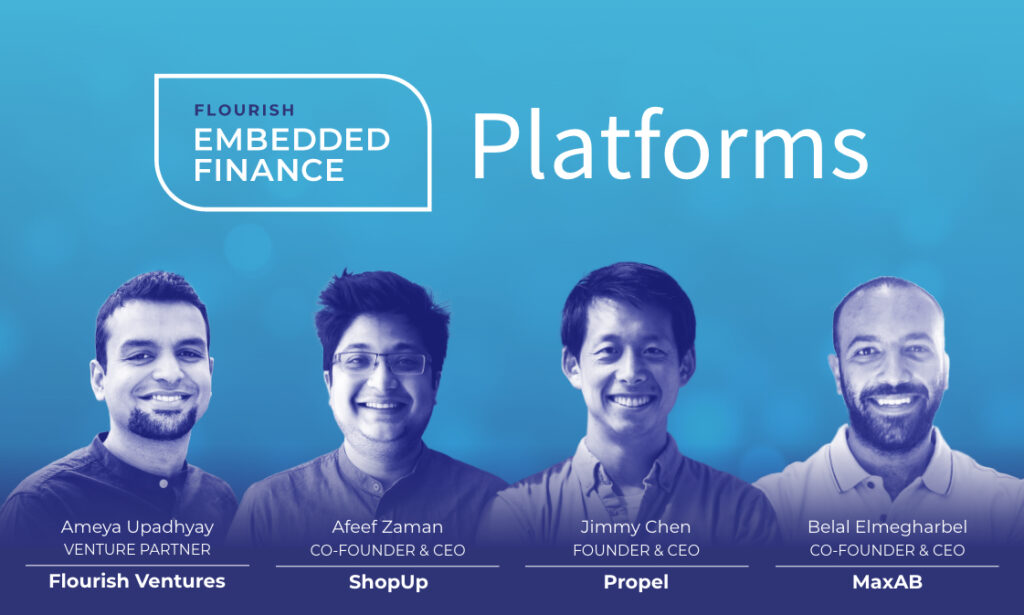

[Flourish Conversations] Embedded Finance Platforms

Embedded Finance allows traditionally non-bank businesses—such as consumer tech companies, retailers, small businesses, and manufacturers—to incorporate financial offerings like payment options, credit, or insurance into their products and better serve their customers. As the world moves increasingly online, embedded finance can play a powerful role in helping consumers and small businesses achieve their goals through greater, better and more transparent access to financial services.

The first event in Flourish Ventures’ Embedded Finance series tackles the embedded finance platforms including gig worker, logistics, social media, and supply chain platforms that are relevant and immediately helpful to people in their daily lives.

Venture Partner Ameya Upadhyay will sit down with three rising global fintech founders from Propel, a technology company based in New York that helps low-income Americans improve their financial health, MaxAB, a B2B e-commerce marketplace in Cairo that connects food and grocery retailers to suppliers in Egypt's most underserved geographies, and ShopUp, a Dhaka-based full-stack B2B commerce platform for neighborhood shops and online sellers, to discuss their business and offer thoughts on questions related to embedded finance such as:

- Why adding specific financial offerings (like insurance) makes sense

- How to decide when to add or buy a financial product (like payments or credit)

- What type of impact (more engagement, higher impact, etc.) are the right success metrics, and how to measure

- How embedded finance platforms will impact overall fintech

- Can embedded finance continue to create impactful and inclusive products?

Watch On Demand