Why We Invested in Cushion: Democratizing Financial Help with AI

Every year, Americans spend more than $60 billion on bank fees and another $140 billion on credit card interest. What most consumers don't know is that often these fees can be reduced or waived by negotiating directly with their banks. Even though most banks are committed to providing fee transparency, this space can still be complex to understand and navigate. And calling a bank to negotiate takes time, persistence, and some skill. It's a level of friction between consumers and their service providers that can make it seem as if the financial system is not working for them.

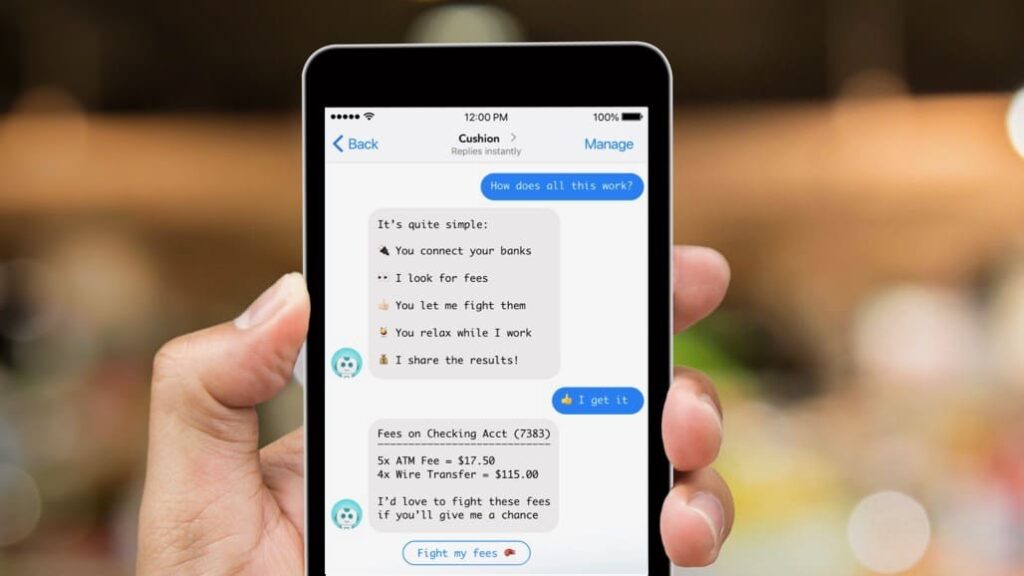

That's why we invested in Cushion. Launched in 2018 to help people hold on to more of their hard-earned money, Cushion's first product is an artificial intelligence (AI) bot, Fee Fighter, that automatically negotiates down bank fees. Most customers get a refund 24 hours after signing up, and amounts can vary between a few dollars and a staggering $2,500.

Getting back some money paid in fees frees up consumers' disposable income and gives them an ally in managing their finances. After securely connecting their accounts—Cushion employs a bank-grade encryption service, so it never sees consumers' login credentials—consumers are able to sit back while Cushion's bot analyzes their payment history, looking for all types of fees. The AI then runs a series of calculations to determine which fees should be negotiated and contacts the bank online or via a secure email or chat.

Since its launch last year, Cushion has helped consumers get fee refunds totaling more than $1 million. The business model behind this is simple, but clever: consumers pay Cushion 25 percent of the refunded amount—a good proposition, since this is money people never expected to get back.

This revenue structure, called gain share, is becoming popular with financial solutions aimed at consumers living paycheck-to-paycheck because the value is not always clear up front, and because it aligns what is good for the consumer with what is good for the business.

In the future, Cushion aims to use its analytics to predict fees or financial difficulties for consumers, and resolve them before they hit. CEO Paul Kesserwani was inspired to found Cushion when he was helping his parents with some bank charges and found over $400 in late fees, interest charges, and foreign transaction fees.

After spending hours on the phone, negotiating refunds or reductions, Paul realized that managing finances is time-intensive work. It's what a CFO or a finance department does for a company.

“We wanted to create a service that does the tedious work of managing customers' day-to-day finances for them, to make sure nothing falls through the cracks,” Paul said. “Our goal is to democratize access to financial help, not just financial advice—enabling consumers to keep more of their money, save, and live financially healthier lives.”

At Flourish, we are excited to support Cushion's mission.