Why We Invested in Zone: Redefining How Payment Infrastructure Works in Africa

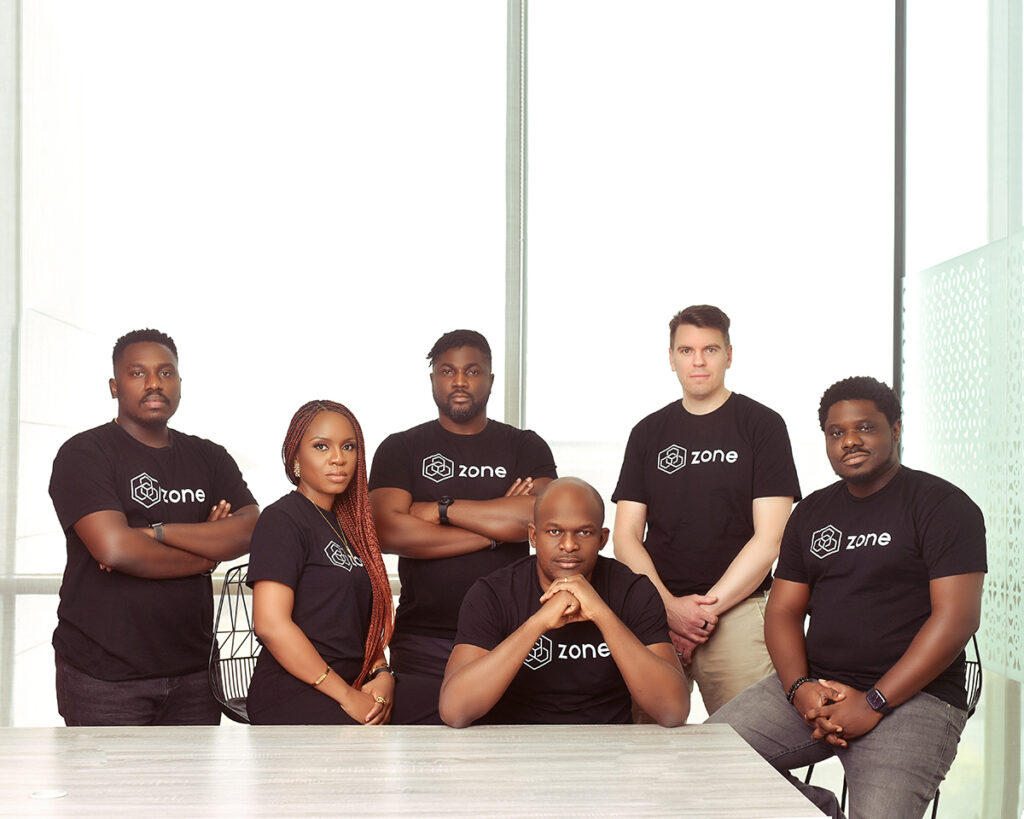

The Zone Team

“Dispense error.” If you are trying to withdraw money from an ATM in Nigeria, there is a 1 in 10 chance that you will see this message instead of counting your cash.

If trying to pay via a POS machine, the odds of transaction failure are roughly 1 in 6. At the heart of these transactions is a switch – a system that works behind the scenes to move money between financial institutions – and Nigeria’s switching industry is an oligopoly where a lack of competition shrinks the incentive for innovation. The result is a stagnant payment network prone to high transaction failure rates, infuriating customers and creating a costly must-solve problem for banks and fintechs.

Decentralization to the rescue

Because all transactions pass through the switch, the system suffers from a single point of failure – an issue known as the “central-intermediary” problem in industry parlance. When the switch is down, money stops moving.

Nigeria-based fintech Zone addresses this issue by operating on a permissioned, proof-of-authority blockchain that is fully licensed by the Central Bank of Nigeria. Banks and fintechs, which operate nodes on the chain, communicate with each other directly. This removes any central intermediary and boosts transaction success rates dramatically. Direct communication also reduces the time and cost involved in reconciliation and dispute resolution. Consequently, despite going live less than a year ago, Nigeria’s 4 largest banks are already using Zone and 18 banks and fintechs are in various stages of onboarding.

The right team

Zone’s co-founders Obi Emetarom and Wale Onawunmi are industry veterans. They have been building mission-critical software for Zone’s customers for more than 15 years. Only the trust built through years of high-quality service can convince banks to change a part of their infrastructure as sensitive as a switch. Zone’s team earned this trust through hard work, resilience, and commitment to quality. We believe the team’s credibility and the software’s performance, reliability and scalability are among their biggest first-mover competitive advantages and are very hard to replicate.

The right ambition

At Flourish, we back businesses that can both scale a novel solution and create a fairer financial system. We believe that Zone’s decentralized approach has the potential to redefine how payment networks operate, not just in Nigeria, but globally. This, in turn, can allow millions of customers to experience a completely new standard of reliability and speed at the ATM, at POS machines and online. The $8.5 million seed round announced today, will help Zone accelerate towards this ambition and we could not be more excited to be part of the journey.