INDIA SPOTLIGHT

COVID-19 Impact on Gig Workers in India

India’s online platform economy has experienced a surge in recent years, expanding from early e-commerce in 2010 to a multitude of service platforms that have helped to formalize gig work opportunities such as ridesharing, delivery, and house cleaning. Online platforms have created new ways for workers to seek out income opportunities and access formal financial services, while also building a digital trail that helps financial institutions and fintechs better understand the needs of an underserved population.

Gig workers in India have been hard hit by the COVID-19 pandemic and accompanying economic dislocation. As the country continues to grapple with the current crisis, financial institutions, fintechs, and platforms have an opportunity and a responsibility to understand the challenges gig workers face, as well as their financial aspirations and concerns as they look toward the future.

As a global fintech investor committed to helping people capture economic opportunity and improve their financial outlook, Flourish Ventures seeks to better understand the financial impact of the pandemic on gig workers and how their livelihoods are changing, as well as how fintechs can better serve this population. This India Spotlight, in partnership with research firm 60 Decibels and local partners Avail Finance and Unitus Capital, represents the fourth study in The Digital Hustle, our global research series. The following results highlight the financial lives, concerns, and aspirations of nearly 800 gig workers in India during August 2020.

Impact on Livelihoods & Well-being

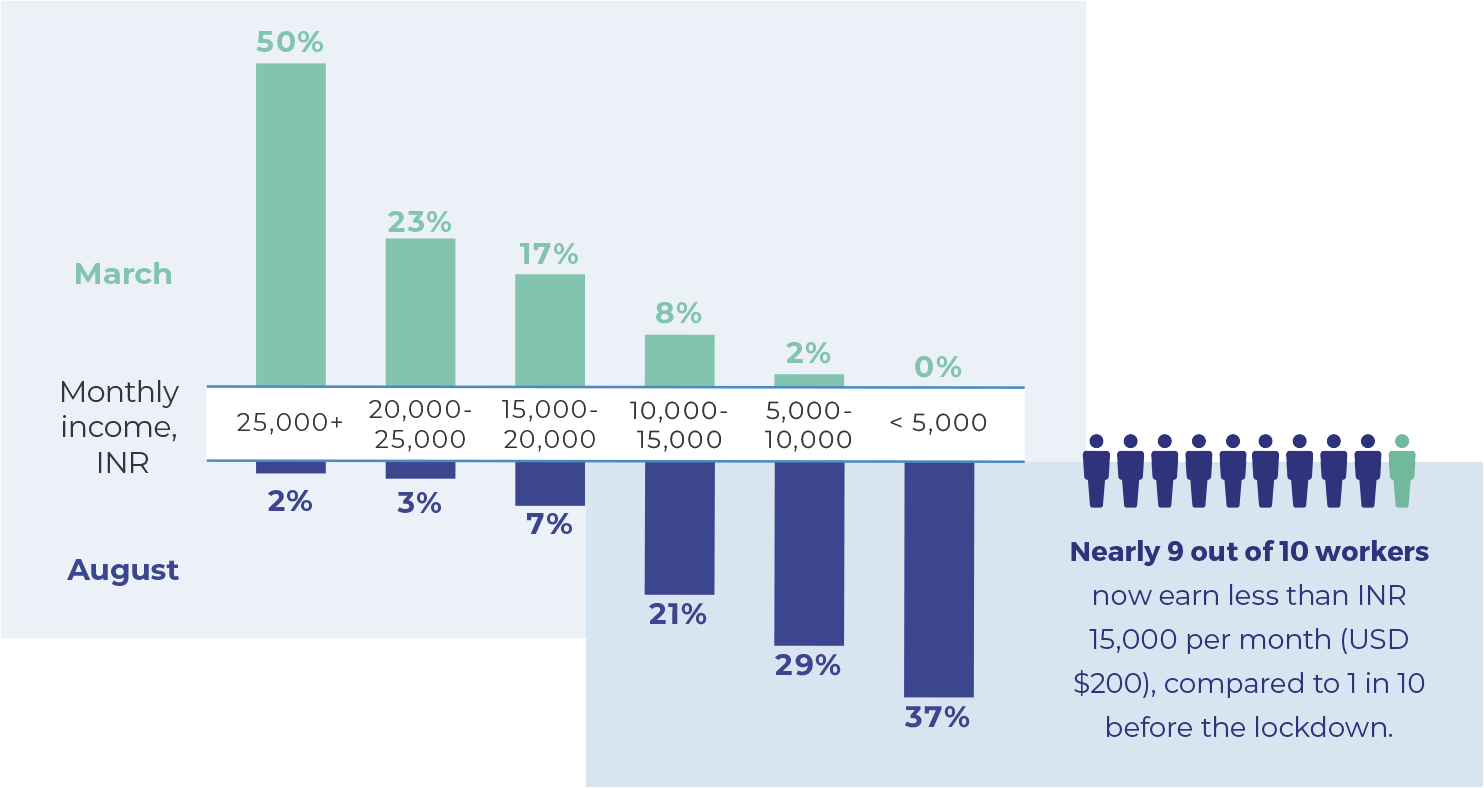

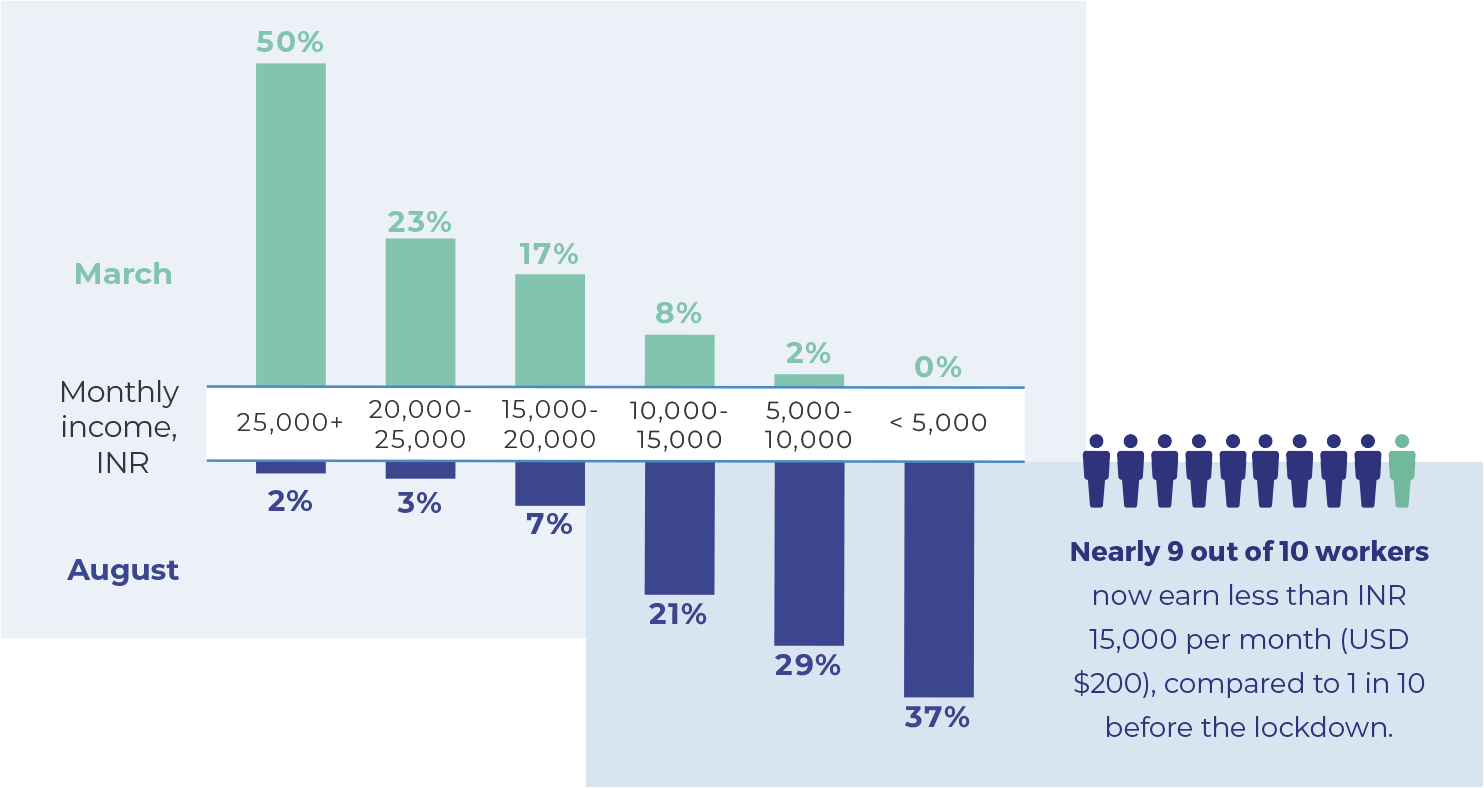

India’s gig workers have been hard hit by the COVID-19 pandemic, with 87% now earning less than INR 15,000 per month (USD $200). Overall, 81% have experienced a large decline in income.

Monthly Income Before & After the COVID-19 Lockdown

"I have had no work since April because no one is going anywhere. There is no hope until the lockdown lifts completely."

– Ridesharing driver, India

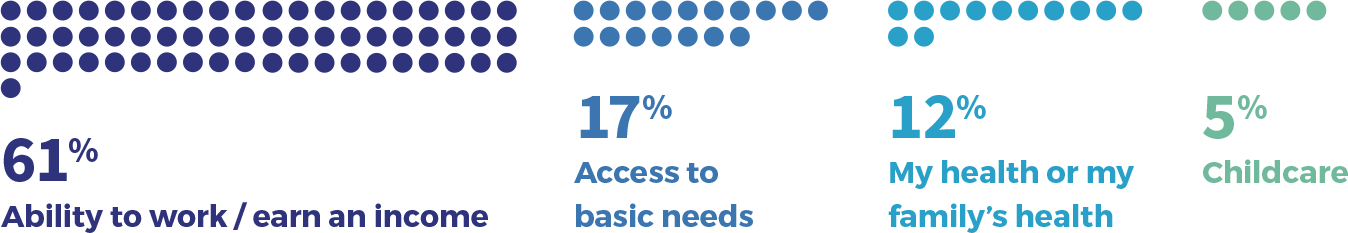

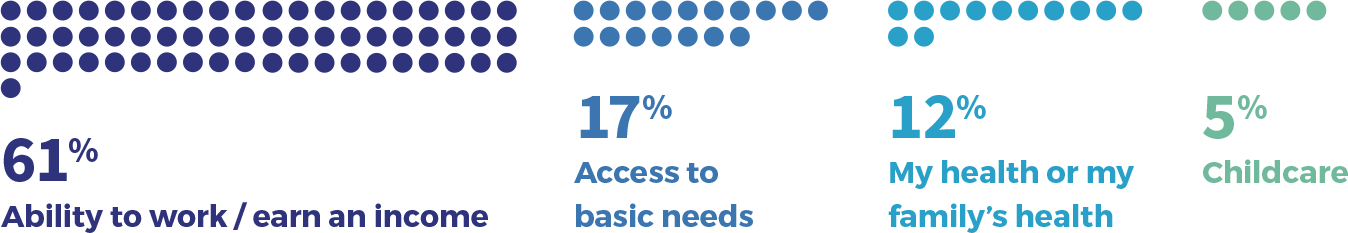

Primary COVID-19 Concerns

Across all respondents, 84% are concerned about COVID-19. At the time of our survey, respondents remain more concerned about the impact to their livelihoods than the risk to their health, indicating that thus far the economic crisis in India has outweighed health concerns for these workers.

Some Gig Workers Impacted More Than Others

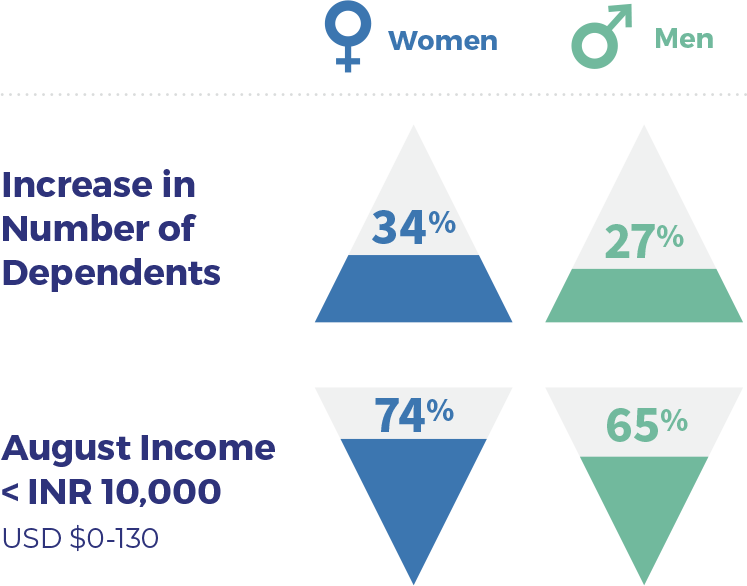

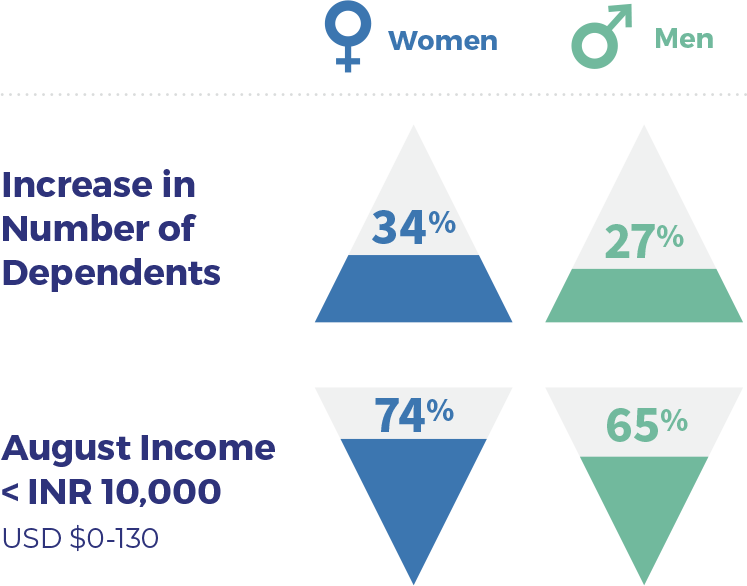

Women continue to be underserved by the gig economy. We had a difficult time finding women to participate in this study, as India’s digital gig economy is dominated primarily by men. Women are underrepresented in the workforce as a whole, and they face a significant hurdle in the gig economy due to unequal access to digital technology. Women in our study (primarily delivery workers and house cleaners) have carried a higher burden of supporting new financial dependents during the COVID-19 crisis, and women continue to have lower incomes than men.

Ridesharing drivers are hardest hit.

The COVID-19 lockdown and subsequent “no touch” economy have hit ridesharing drivers hardest, although all industries have been affected.

Large Decline in Income

90% Ridesharing drivers

75% Delivery workers

72% House cleaners

Large Decline in Quality of Life

69% Ridesharing drivers

48% Delivery workers

48% House cleaners

Government aid has alleviated some hardship.

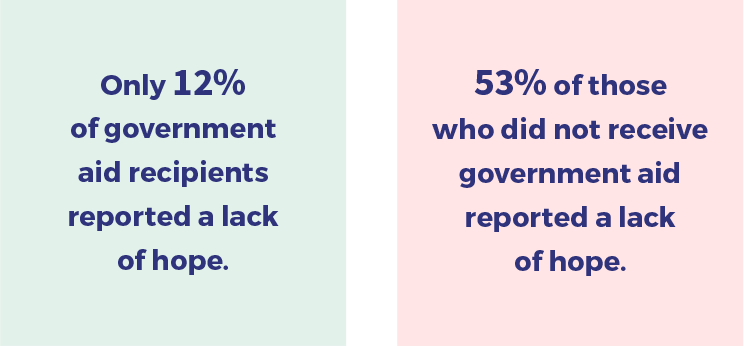

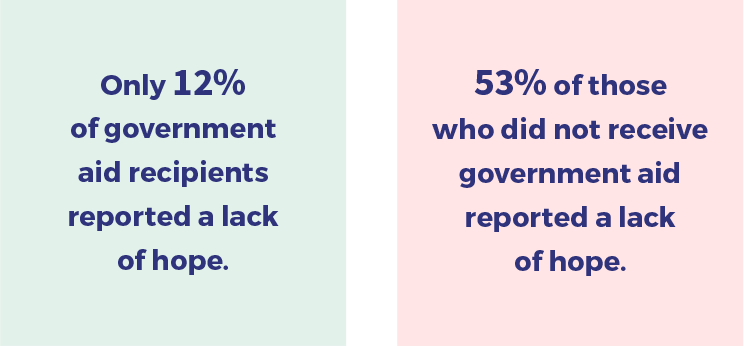

42% of respondents received food provisions or financial support from the government as part of the COVID-19 relief efforts. While still struggling, government aid recipients have a stronger sense of hope than those who did not receive aid.

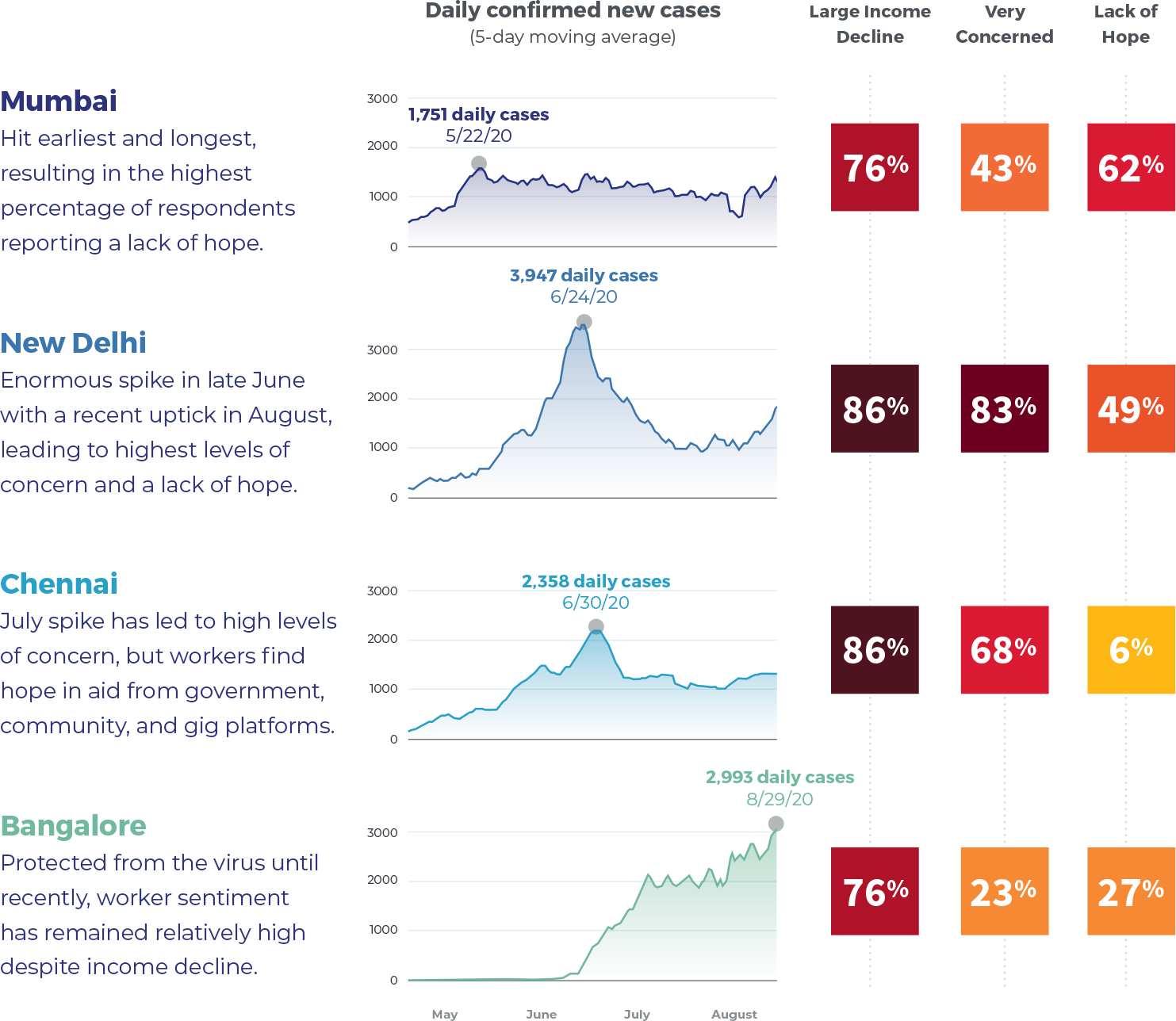

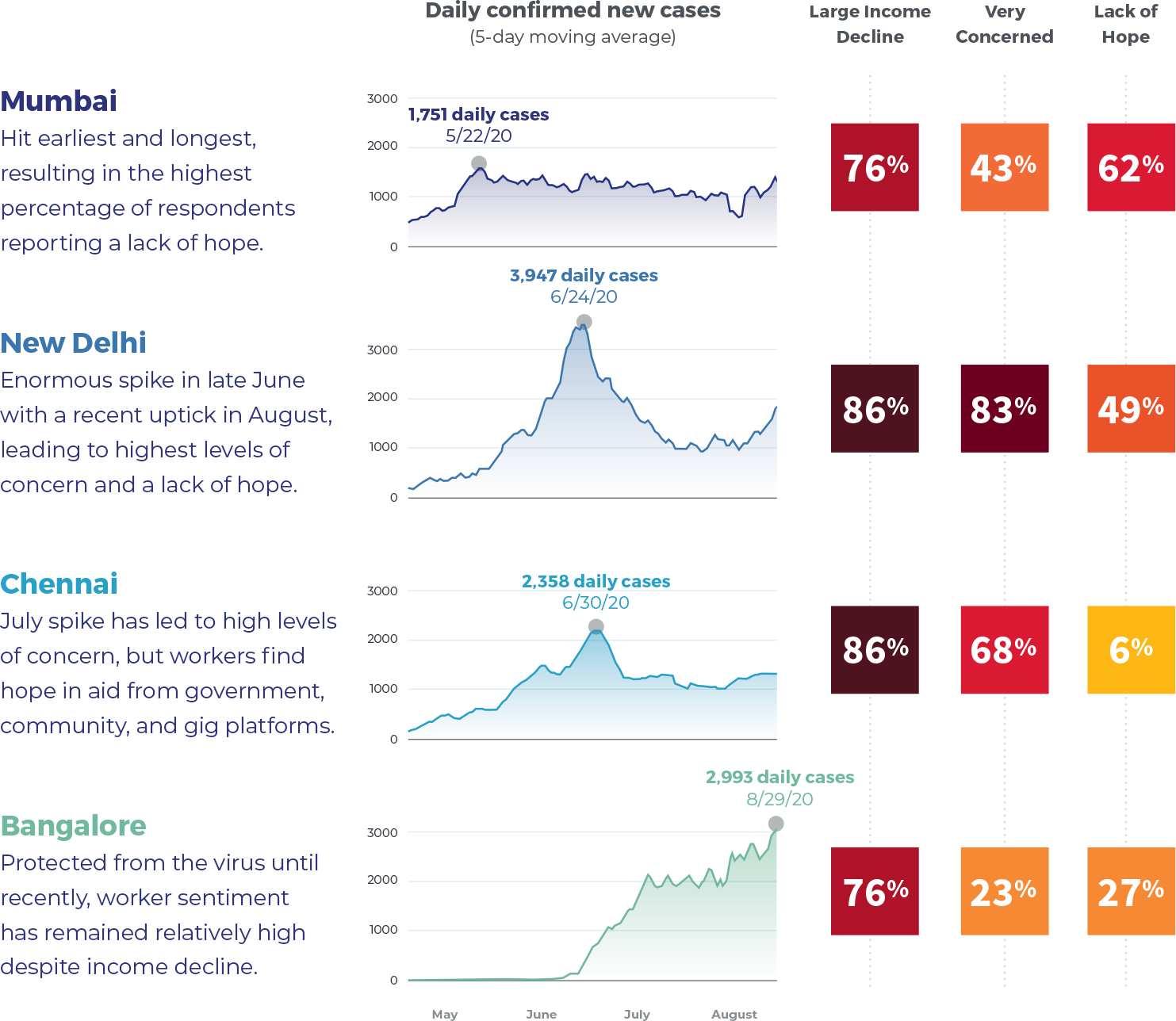

Early City Epicenters Reaching State of Despair

Worker sentiment varies widely by city based on the length and severity of the health crisis and economic dislocation. Lack of hope is widespread in Mumbai and New Delhi, which experienced the earliest virus outbreaks and longest lockdowns. Concerns are widespread in Chennai as well, where residents faced a recent spike in COVID-19 cases in July.

Source: Times of India Coronavirus Cases

Financial Resilience

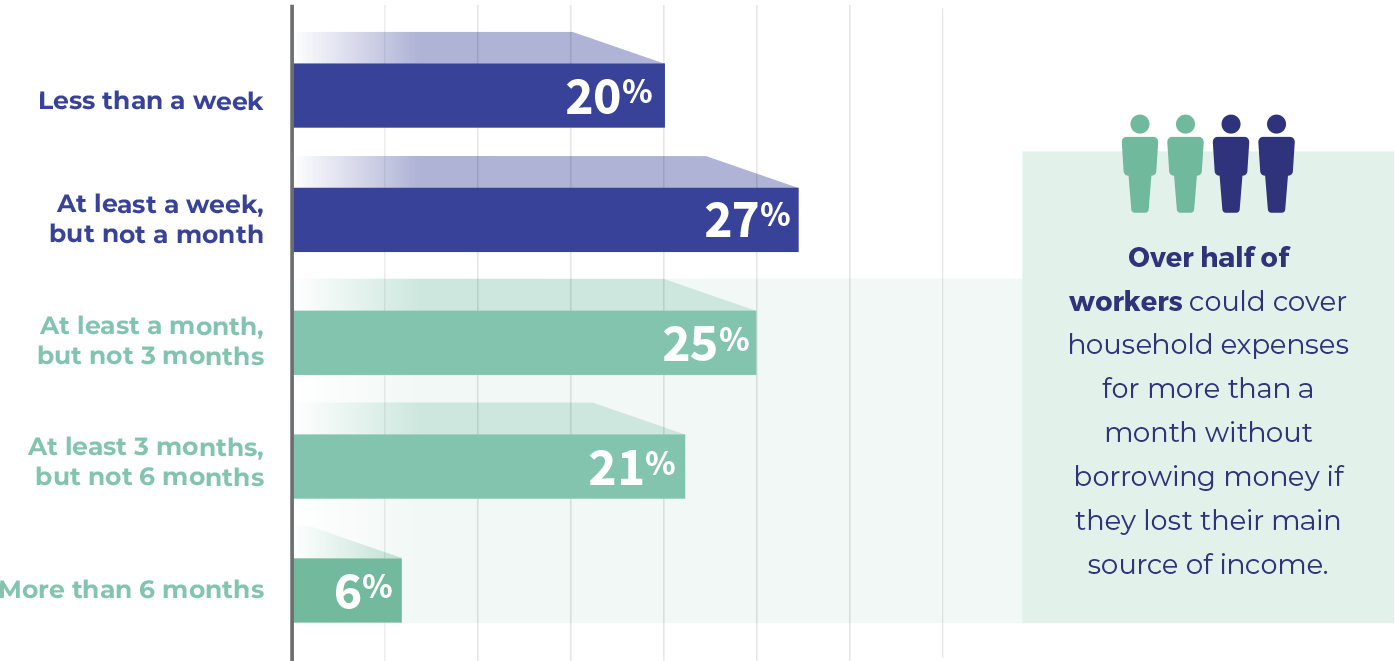

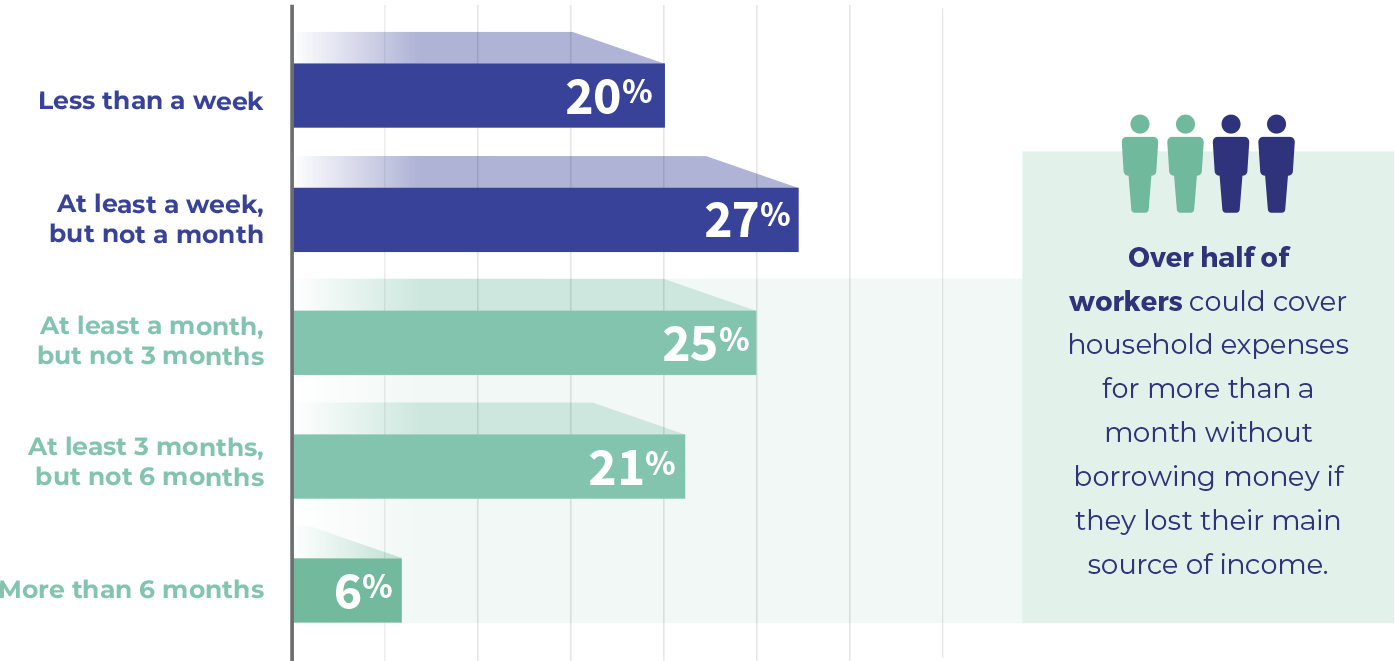

Some gig workers have a financial cushion, indicating greater resilience than expected.

If you lost your main source of income, how long could you continue to cover living expenses without borrowing money?

"I am a self reliant person. I have my own bike and I have purchased my home. My company has paid me INR 300 daily during lockdown, and the rest I have covered with savings."

– Delivery worker, India

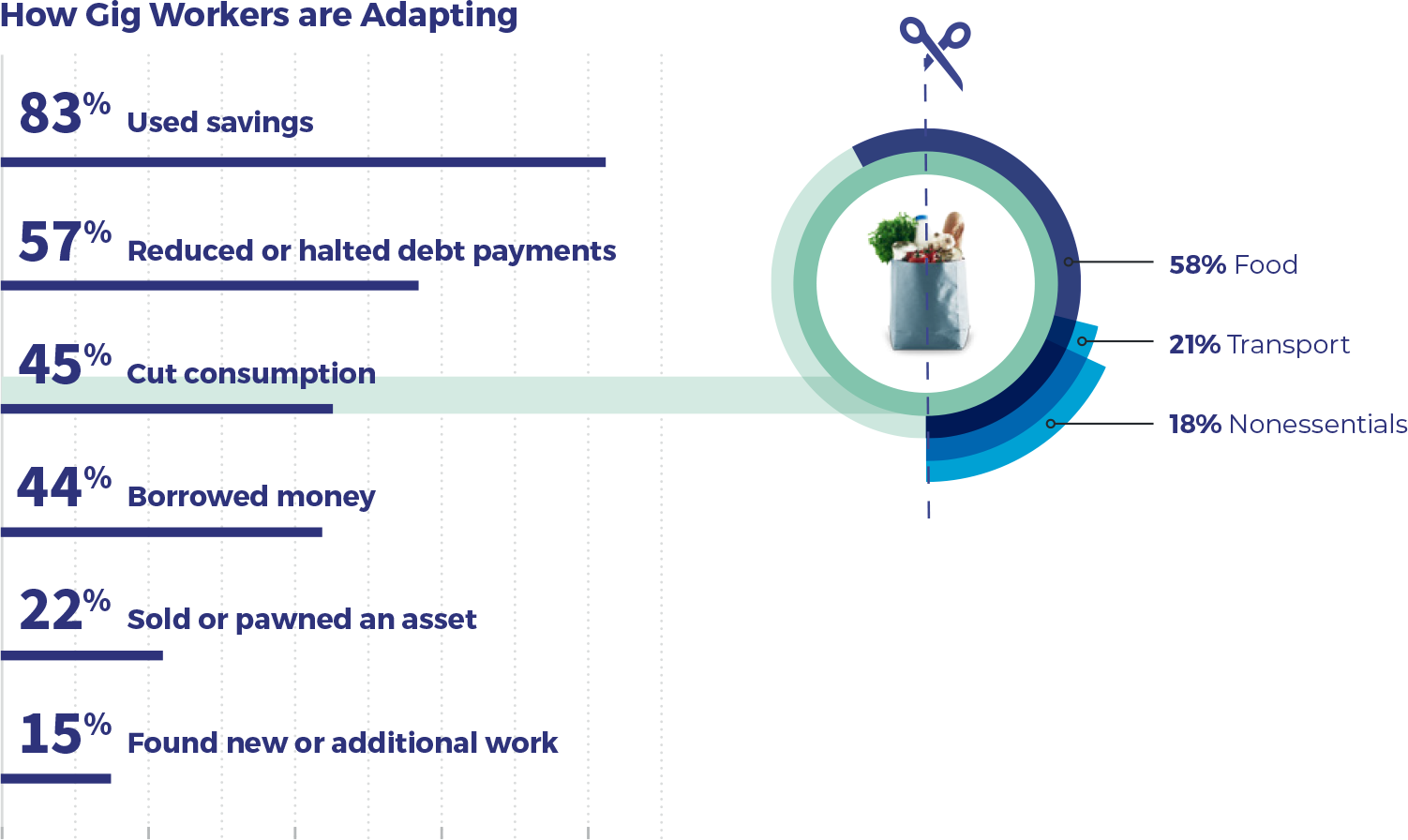

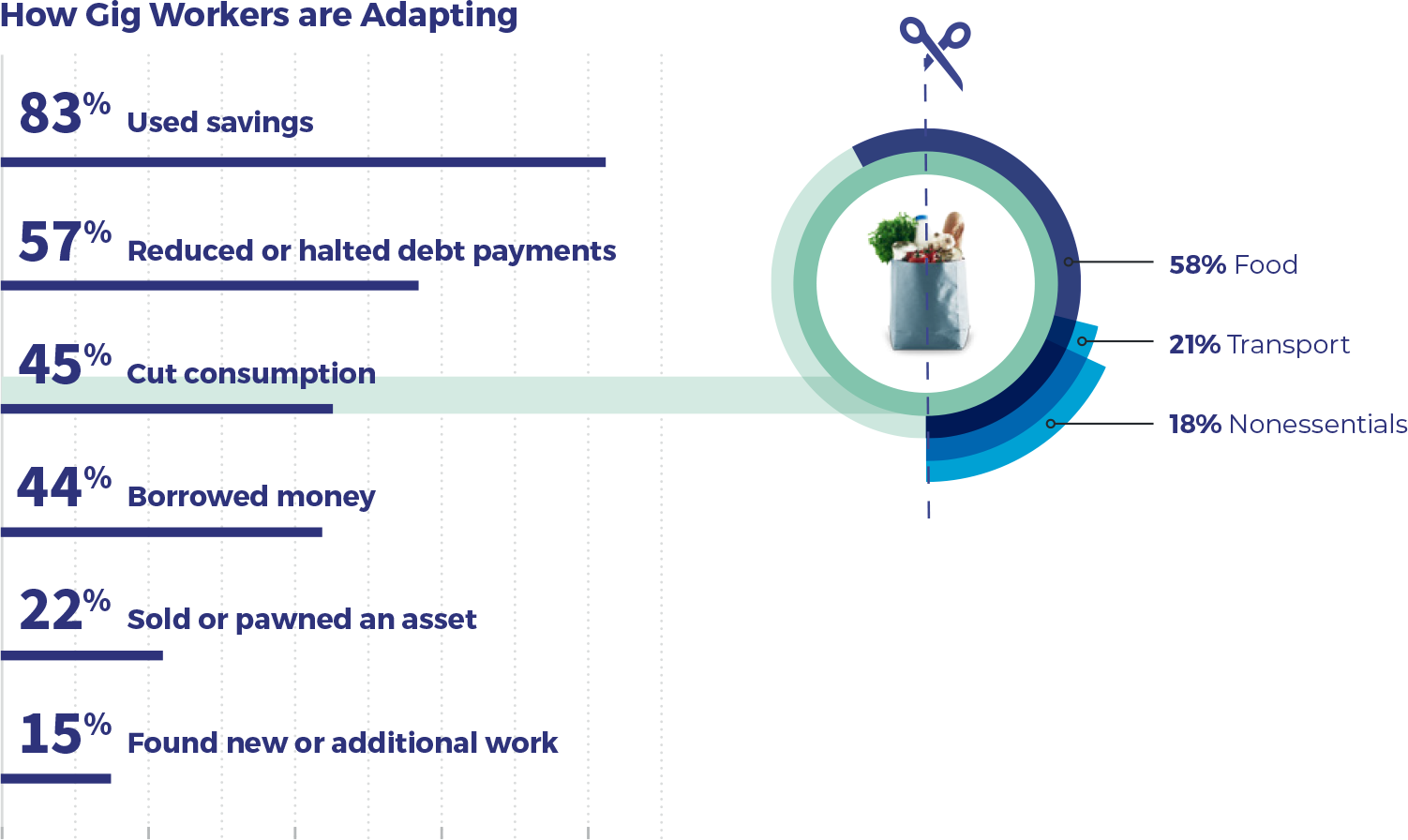

Coping Mechanisms

Most gig workers have made sacrifices to cope with the COVID-19 crisis. 83% have relied on savings, 45% have reduced consumption, and 44% have borrowed money. Acting on the government sponsored loan moratorium, 57% have reduced or halted debt payments. Yet only 15% are finding new or additional work - likely because of the strictly enforced lockdown.

"I haven’t been able to pay my children’s school fees. We eat mostly rice and lentils now. We have reduced our vegetable consumption and we stopped drinking milk and tea."

– Ridesharing driver, India

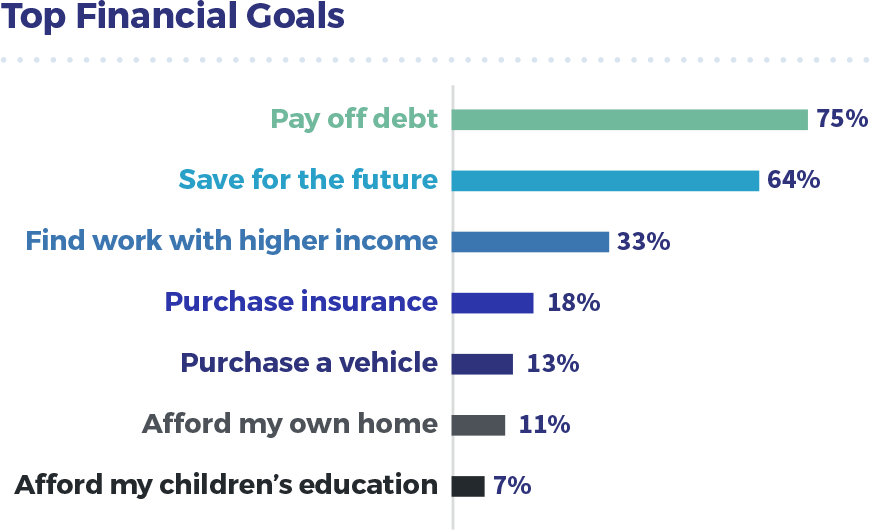

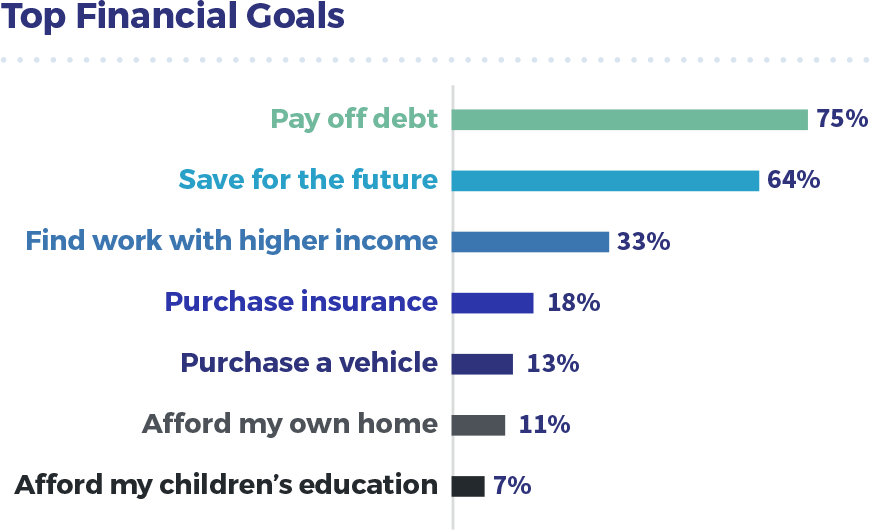

Looking Forward

As the lockdown lifts, workers seek to return to work and build greater financial stability. In the next 6 months, 89% of respondents confirmed they plan to continue with their previous work from before the crisis. 61% of respondents indicated that they need support in planning toward their financial goals.

Planning for the future is a top priority. 62% of respondents are very concerned with their ability to save for old age, and 61% are very concerned with ability to pay off debt. Debt repayment and saving for the future are also the top two financial goals across all respondents.

Security is a moderate concern, particularly the risk of not being able to work. A number of respondents are meaningfully concerned about inability to work if they get sick or in an accident (26%), or if they damage their phone or vehicle (14%). Notably, a significant number of respondents (18%) listed purchasing insurance (health, life, or asset) as a top financial goal.

Ability to manage day-to-day cash flows is a moderate concern. One in four respondents expressed a high level of concern about accessing sufficient cash for day-to-day work needs. This indicates that workers may lack short term liquidity to bridge the gap between daily work expenses (such as fuel) and payment.

Top Financial Concerns

% Very Concerned

62% Ability to save for old age

61% Ability to pay off debt

26% Risk of getting sick or in an accident and not being able to work

25% Access to sufficient cash to do my job

14% Risk of vehicle or phone breaking and not being able to work

11% Access to financing for assets

"There is risk in my work. We are traveling and meeting people. If I fall sick then I cannot work or make money."

– Delivery worker, India

The Case for Fintech Solutions

The India Spotlight provides some early insights that may inform how platforms and financial service providers can best serve a growing digital gig workforce. We believe fintech solutions have the potential to advance economic opportunity and improve gig workers’ financial outcomes. Gig platforms have become a growing form of employment for previously informal workers in India, and we expect this to be sustained through the pandemic and beyond. Yet there remains an important need among gig workers for access to formal solutions for financial planning, income protection, and day-to-day cash flow management.

Survey Methodology

Flourish Ventures partnered with 60 Decibels, Avail Finance, and Unitus Capital to conduct an online survey of 770 gig workers in August 2020. Of these respondents, there were 322 ridesharing drivers, 307 delivery workers, and 141 house cleaning workers. Underlying data can be viewed here.

Authors: Tilman Ehrbeck, Harsh Gupta, Stella Klemperer, Anuradha Ramachandran