INDONESIA SPOTLIGHT

COVID-19 Impact on Gig Workers in Indonesia

In recent years, Indonesia’s digital gig work has taken off, driven by rapid growth in the mobile sector—with 176 million Indonesians subscribing to a mobile service - and matched by a vibrant online economy. This growth created opportunities for informal workers to enter the formal economy and financial system. Gig platforms have provided new ways for informal workers to earn a living - for example through ridesharing, online sales, household services, and delivery - while also creating a new channel to better understand and meet the financial needs of an often more vulnerable and underserved population.

The COVID-19 pandemic and its economic fallout have hit Indonesia’s digital gig workers hard. As the country and the rest of the world continue to grapple with the challenges of the current crisis, we have an opportunity and an obligation to learn more about the financial outlook of gig workers and apply these learnings across Southeast Asia.

As a global fintech investor committed to helping people capture economic opportunity and improve their financial wellbeing, Flourish Ventures seeks to better understand the financial impact of the pandemic on gig workers, how their livelihoods are changing, and how fintechs can better serve this population. This Indonesia Spotlight, in partnership with research firm 60 Decibels and local gig worker platform Sampingan, represents the third study in The Digital Hustle, our global research series. The following results highlight the financial lives, concerns, and aspirations of nearly 600 gig workers in Indonesia during June and July 2020.

Impact on Livelihoods & Well-being

Indonesia’s gig workers have been hard hit by the COVID-19 pandemic, with 79% now earning less than $100 (IDR 1,500,000) per month. Overall, 86% of respondents have experienced a decline in income.

Monthly Income Before & After the COVID-19 Lockdown

"There are no more orders. My income has dropped by 90% since the COVID-19 lockdown."

– Online seller

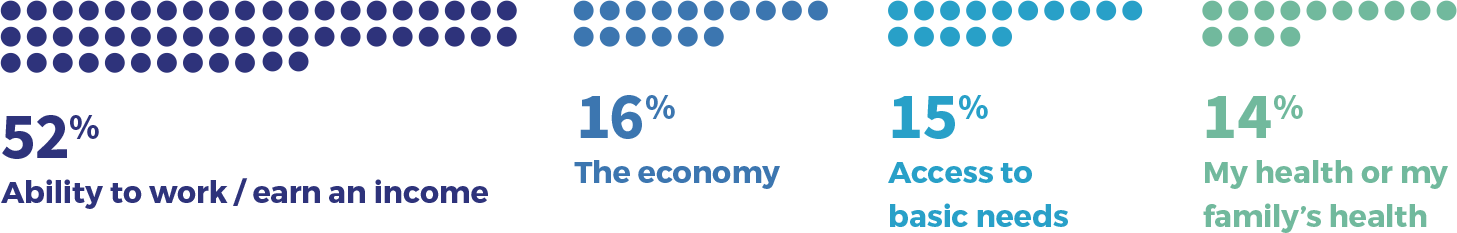

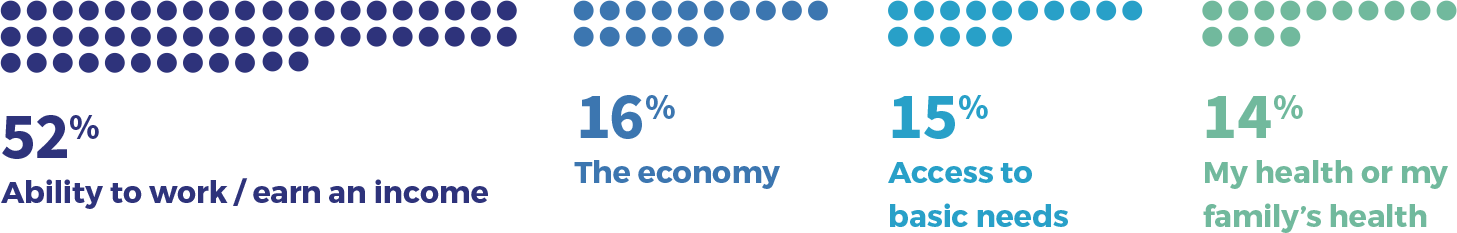

Primary COVID-19 Concerns

Across all respondents, 74% are very concerned about COVID-19. At the time of our survey, respondents remain much more concerned about the impacts to their livelihoods rather than the risks to their health, indicating that thus far the economic crisis in Indonesia has outweighed the health crisis.

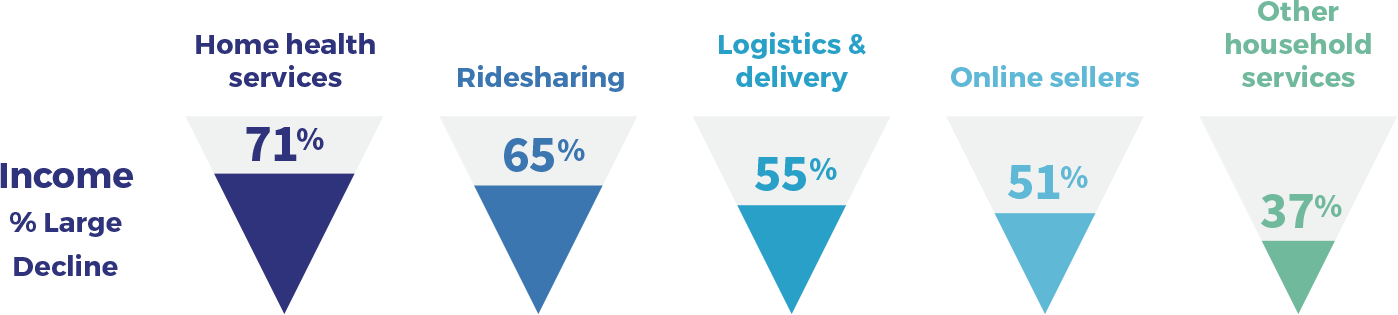

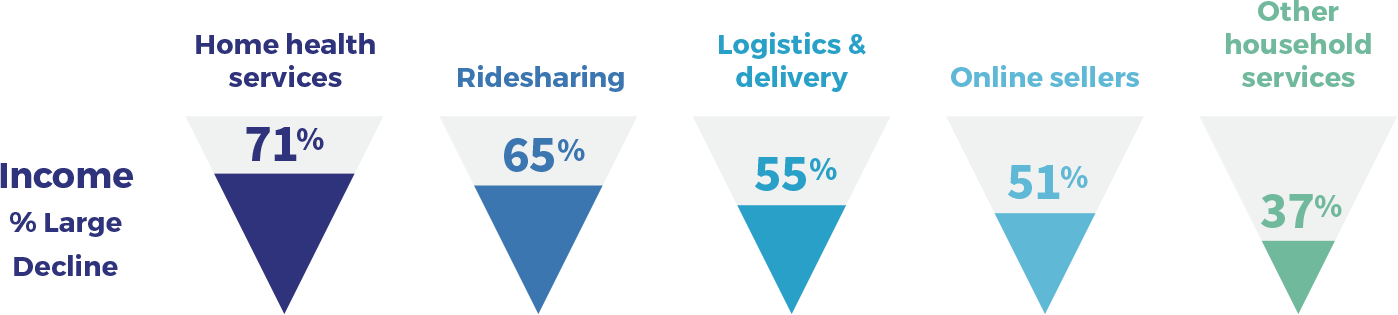

Some Gig Workers Impacted More Than Others

While Indonesian gig workers have experienced a contraction in demand across all industries, massage and ridesharing reported the largest losses. Industries requiring in-person interactions – home health services (such as mobile massage) and ridesharing – were hit the hardest, while lower-touch work such as online selling and other household services (such as house cleaning) were impacted less. Surprisingly, delivery was also hard hit.

Large cities hit hardest. Workers in cities with more than one million residents were hit harder than those in smaller cities, as these were more severely impacted by the pandemic and lockdown restrictions.

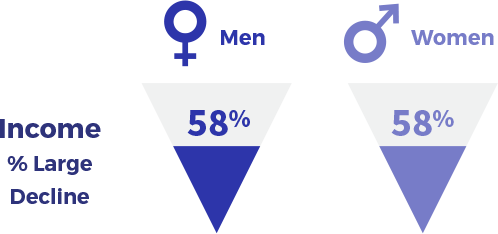

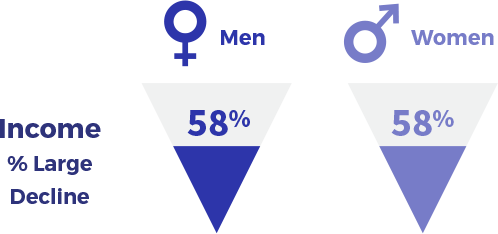

No notable gender disparities. Men and women reported equal financial impact as a result of the COVID-19 crisis, unlike in other countries where we have seen meaningful differences in gender outcomes. For context, the gender gap in Indonesian mobile phone ownership is only 11%, versus 26% in India.

Financial Resilience

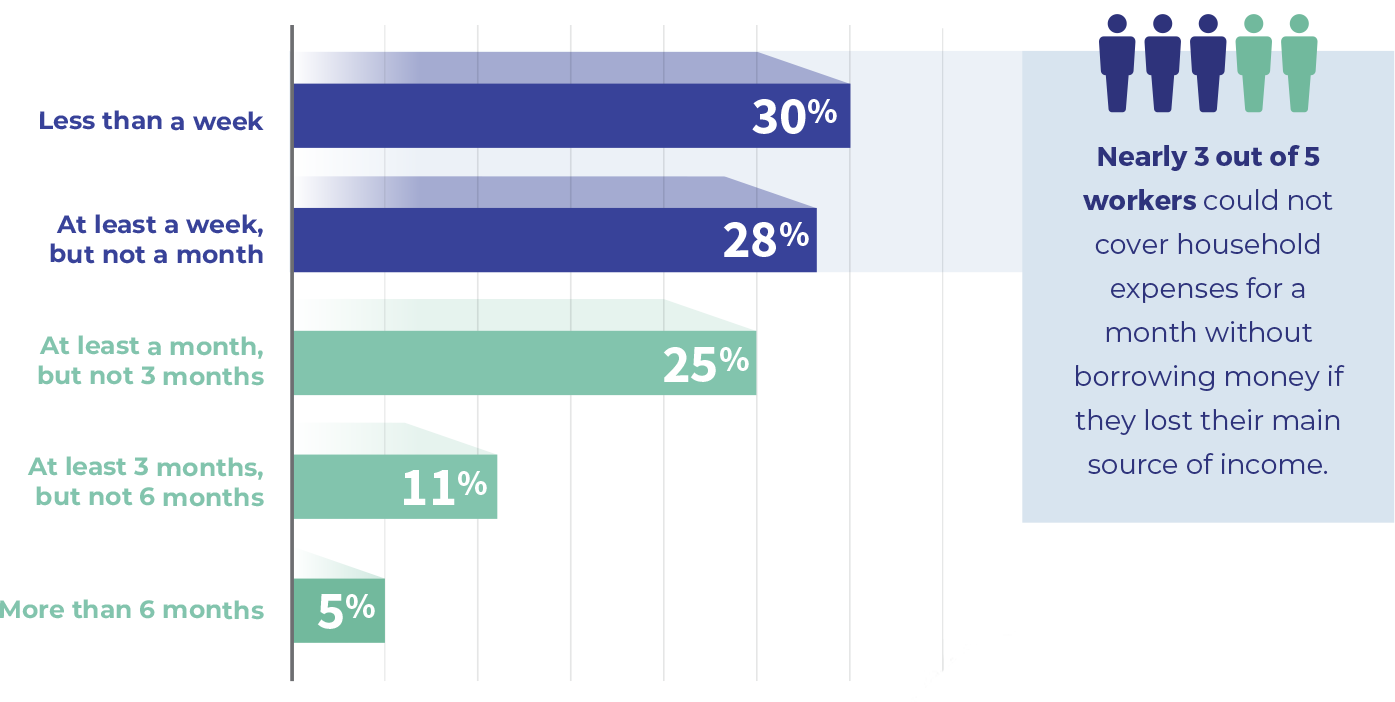

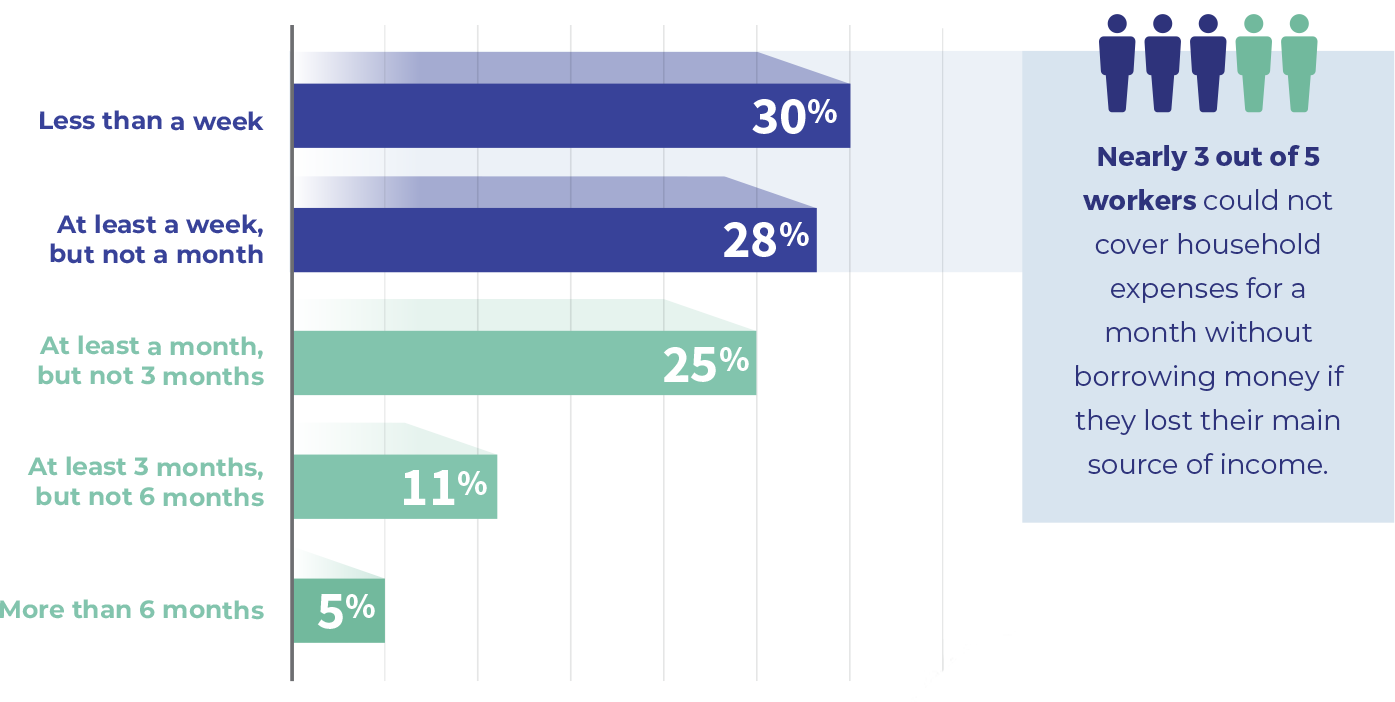

Gig workers are living on the edge. 58% of respondents reported that they could not cover household expenses for a month without borrowing money, if they lost their main source of income.

If you lost your main source of income, how long could you continue to cover living expenses without borrowing money?

"I have sold nearly all my belongings to meet my household’s needs. There is no work and we are struggling to pay rent."

– Home health services worker

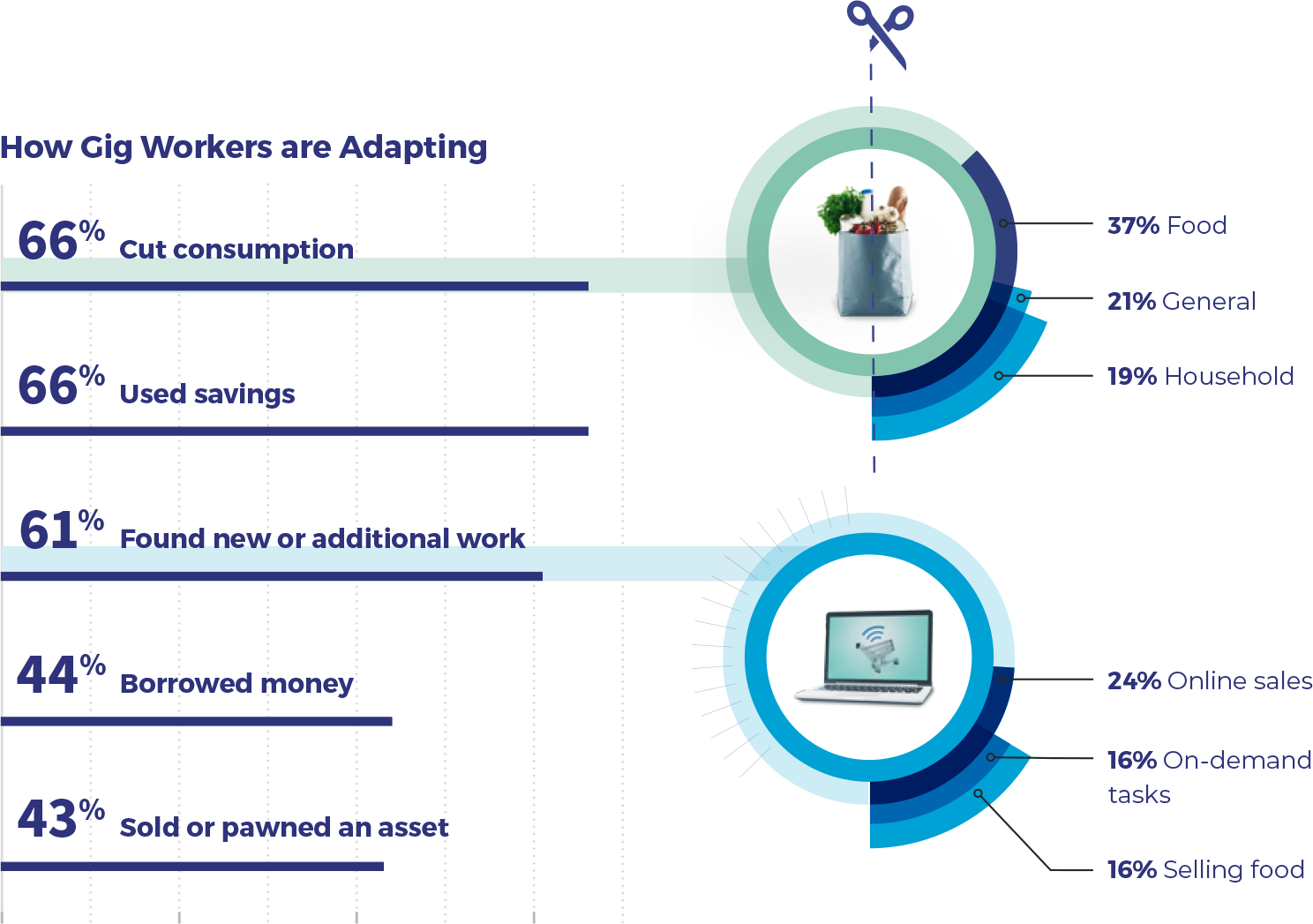

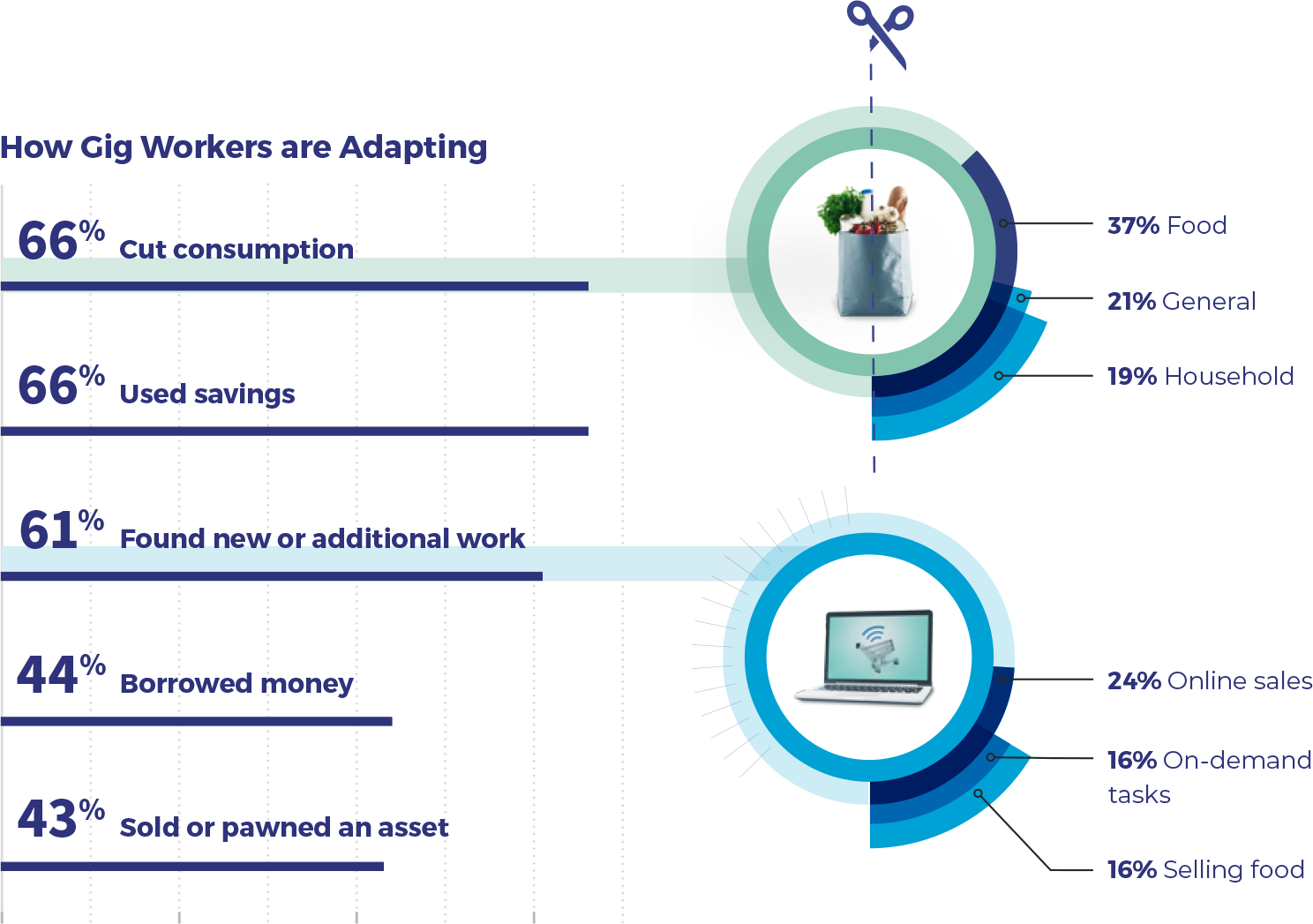

Coping Mechanisms

While most gig workers have made sacrifices to cope with the COVID-19 crisis, today more than half are pursuing new work opportunities.

"I can only afford 1-2 meals per day now. We used to eat meat, but we cannot afford it anymore."

– House cleaner

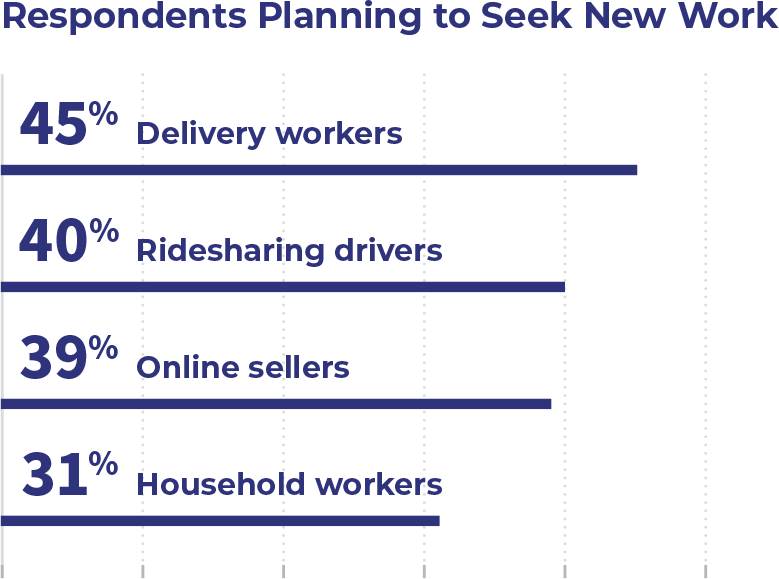

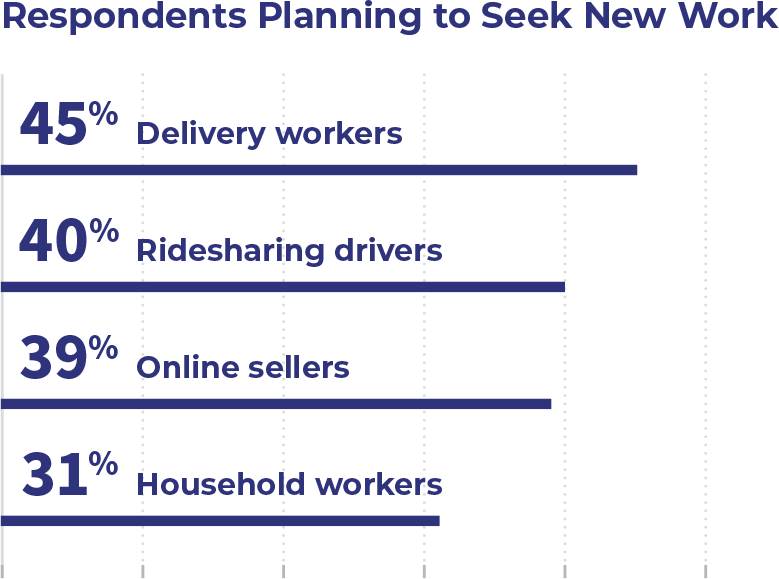

Workers’ Future Plans

As the pandemic continues, respondents’ primary focus is on securing an income. Across all respondents, 37% plan to look for new work. Of these, a sizable number of respondents are looking to the gig economy for future income, with 13% seeking remote or on-demand work, 10% planning to move into online selling, and 10% planning to work in delivery.

"I am looking for online data entry work and other on-demand tasks that I can do via my smartphone.”

– Delivery driver

Looking Forward

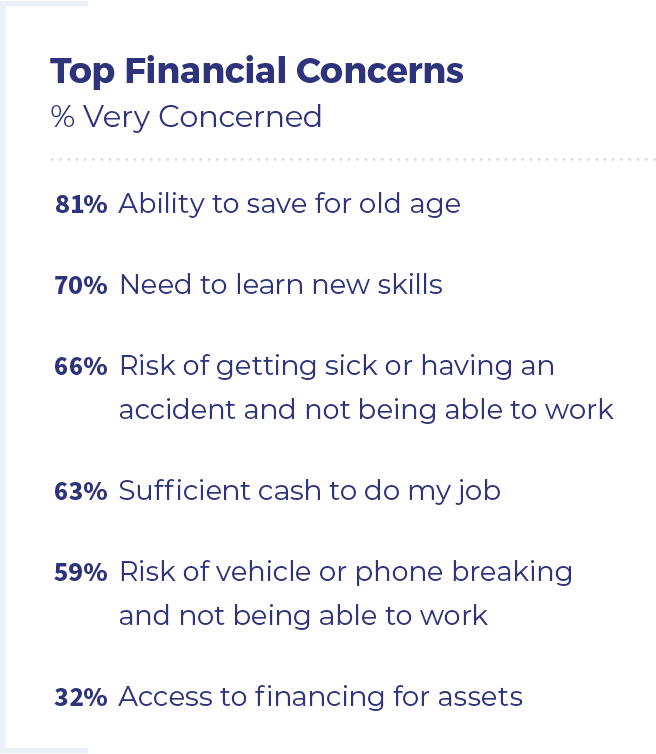

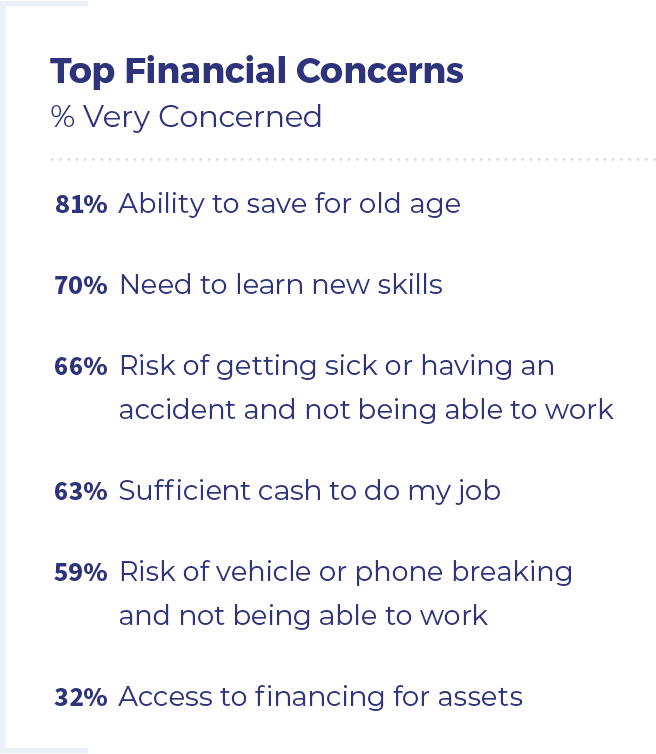

Planning for the future is a top priority. 81% of respondents are very concerned with their ability to save for old age, and saving is the number one short term and long term goal. 70% are also very concerned with the need to learn new skills for work.

Security is a top of mind – specifically, the risk of not being able to work. Most respondents are very concerned about not being able to work if they get sick or in an accident (66%), or if they damage their phone or car (59%), highlighting a potential unmet need for insurance products to protect against risk.

Workers more anxious about short term cash needs than longer term financing. 63% of respondents are very concerned about having sufficient cash to do their job, versus only 32% who are concerned about access to asset financing.

Top Financial Goals

Short-term

- Save to support myself and my family

- Pay off debt

- Find work with better pay

Long-term

- Save to support me and my family

- Afford my own home

- Pay off debt

"I hope my hard work this year pays off. I want to make my parents proud, build a house, and buy a car for my family."

The Case for Fintech Solutions

We believe fintech solutions have the potential to advance economic opportunity and improve gig workers’ financial outcomes. Gig platforms have become a major form of employment for low- and middle-income workers in Southeast Asia, and we expect this to be sustained through the pandemic and beyond. Yet there remains an important need among gig workers for access to financial and risk management products that help with short term liquidity and income protection support, as well as a desire to develop new skills and build longer term resilience. The Indonesia Spotlight provides some early insights that may inform how platforms and financial service providers can best serve this emerging digital workforce.

Survey Methodology

Flourish Ventures partnered with research firm 60 Decibels and gig worker startup Sampingan to conduct an online survey of 586 gig workers in June and July 2020. Of these respondents, there were 221 ridesharing drivers, 191 home services providers (house cleaning, beautician, and massage), 109 online sellers, and 65 delivery workers. Underlying data can be viewed here.

Authors: Smita Aggarwal, Tilman Ehrbeck, Stella Klemperer”